Irish Grid Monthly Recap, October 2024

Hello!

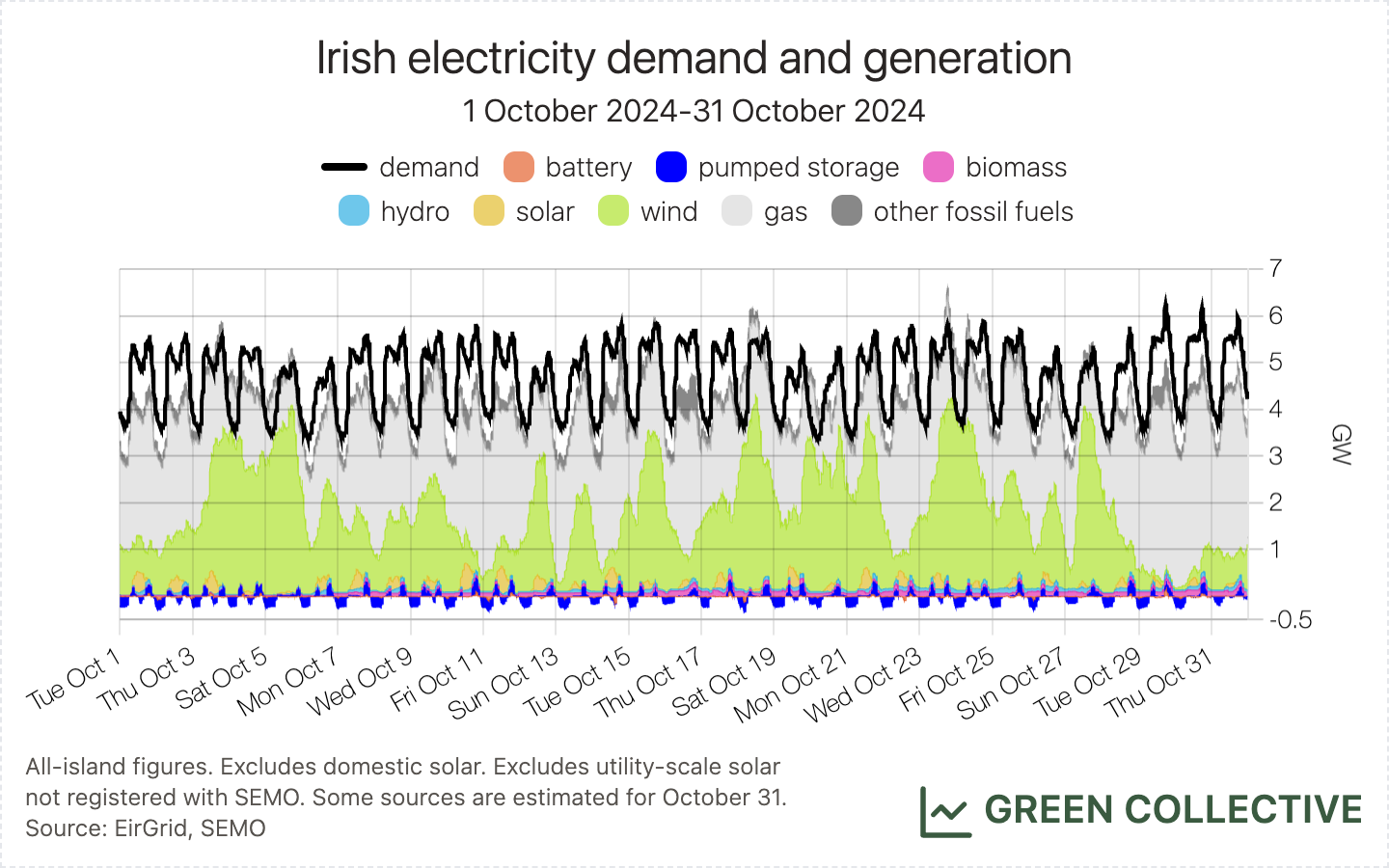

When we set out to write this report, our intuition was that October 2024 had been a "business as usual" kind of month for the grid: winds were about normal for this time of year, solar was unsurprisingly down from the heights of summer, etc. However, as we dutifully crunched the numbers for posterity we discovered several welcome and surprising new highs hidden in the data. There are no boring months on the grid!

Summary

Generation from renewable sources during October 2024 equalled 39.1% of all-island electricity demand:

- 34.9% wind

- 1.3% hydro

- 1.4% biomass

- at least 1.5% solar

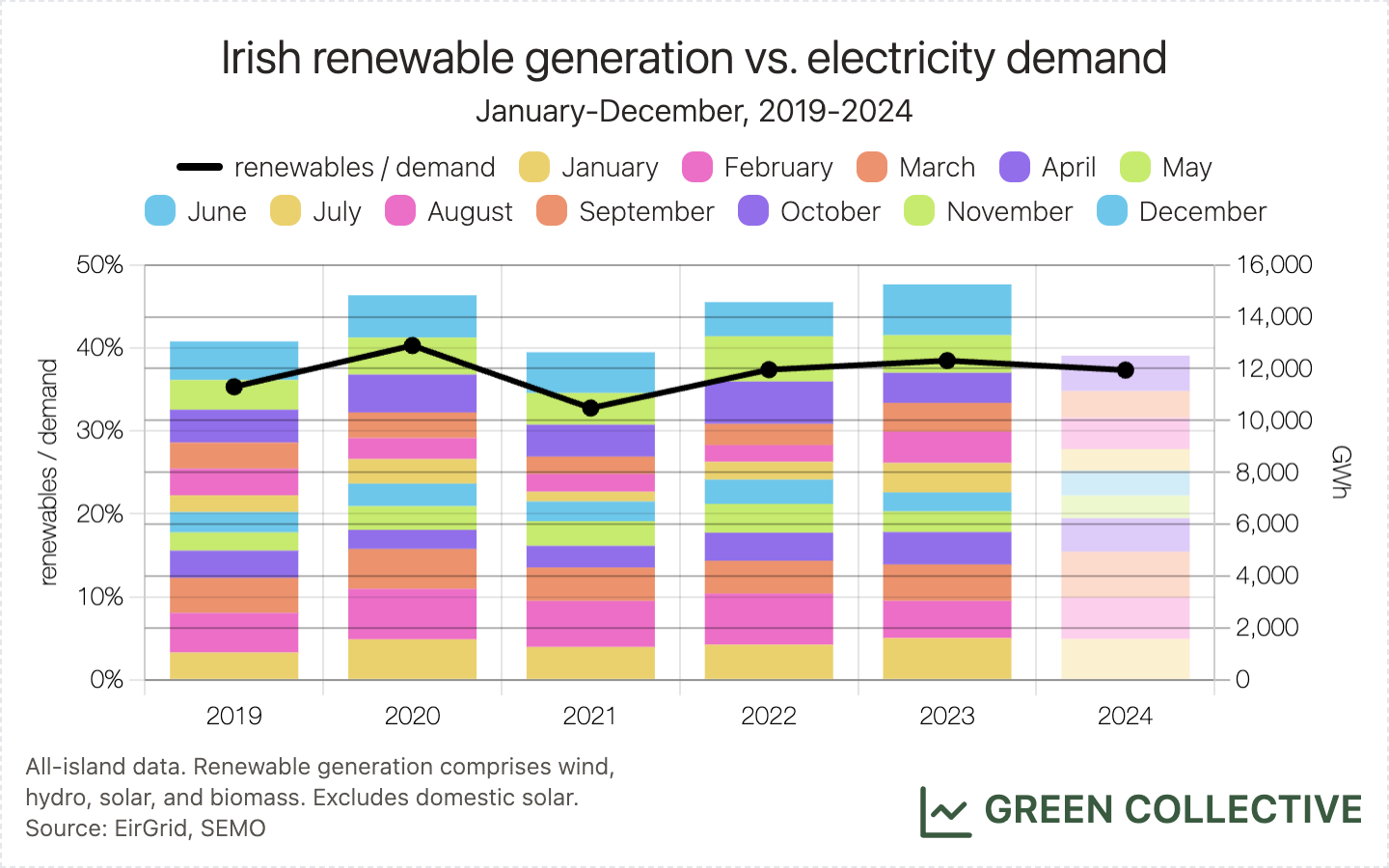

1366GWh from renewables was significantly up from October 2023's 1161GWh. Although well short of 2020 and 2022 (>1.4TWh and >1.6TWh, respectively), this was nevertheless the third-best October month yet for Irish renewables in terms of both generation and renewables/demand ratio.

So far in 2024, renewables have met 37.3% of demand.

Comparing the first ten months of 2024 renewable generation with the same period in past years, only 2020 fared better in terms of renewables/demand ratio. 2020, of course, remains an outlier in terms of electricity demand; in terms of generation, >12TWh from renewables in 2024 is significantly more than we've seen in any previous year by November 1. Barring an unusually calm November or December, 2024 has a good chance of claiming top spot (and is almost certain to reach #2).

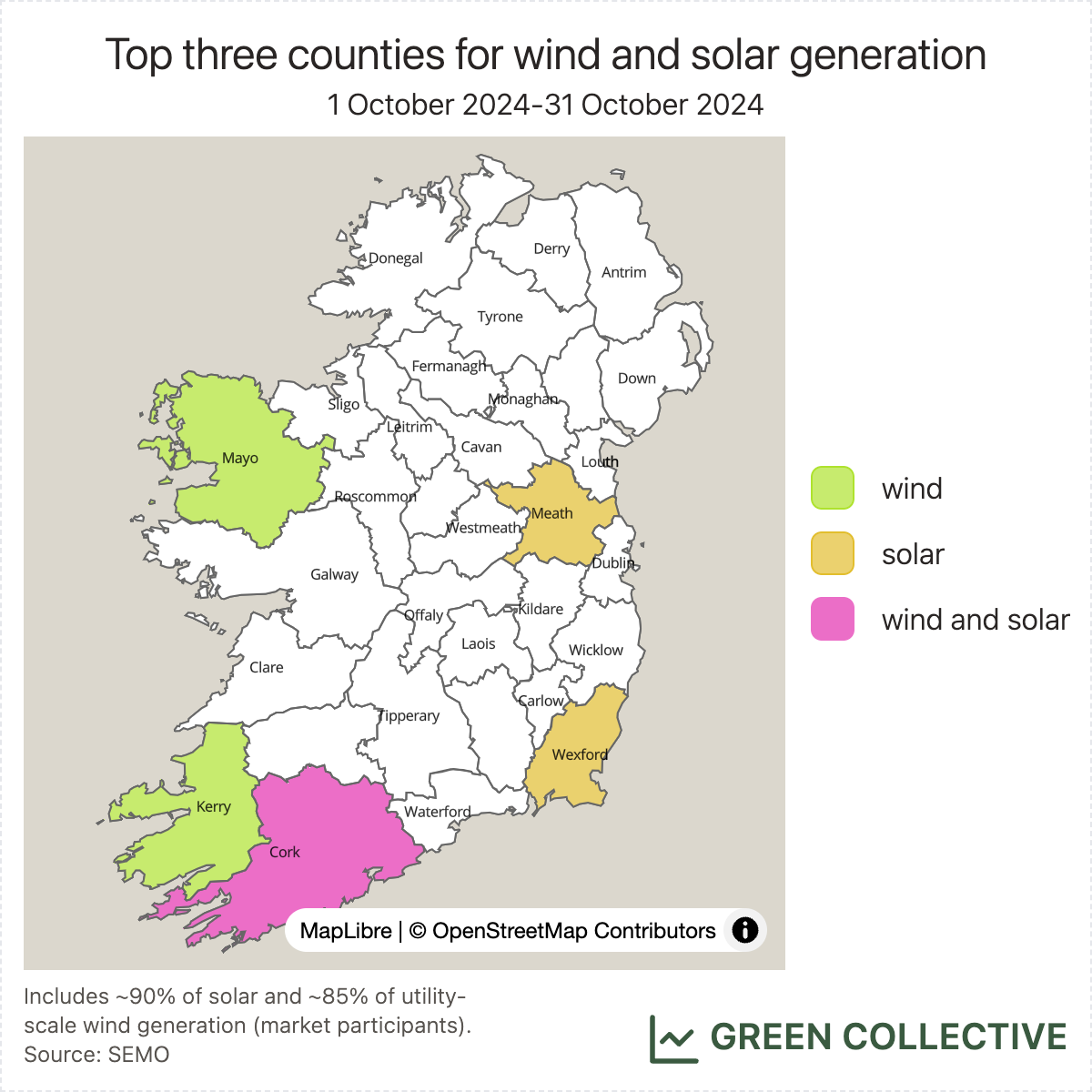

Top Counties for Wind and Solar

Top counties for wind:

- Kerry

- Cork

- Mayo

Top counties for solar:

- Meath

- Wexford

- Cork

Wind

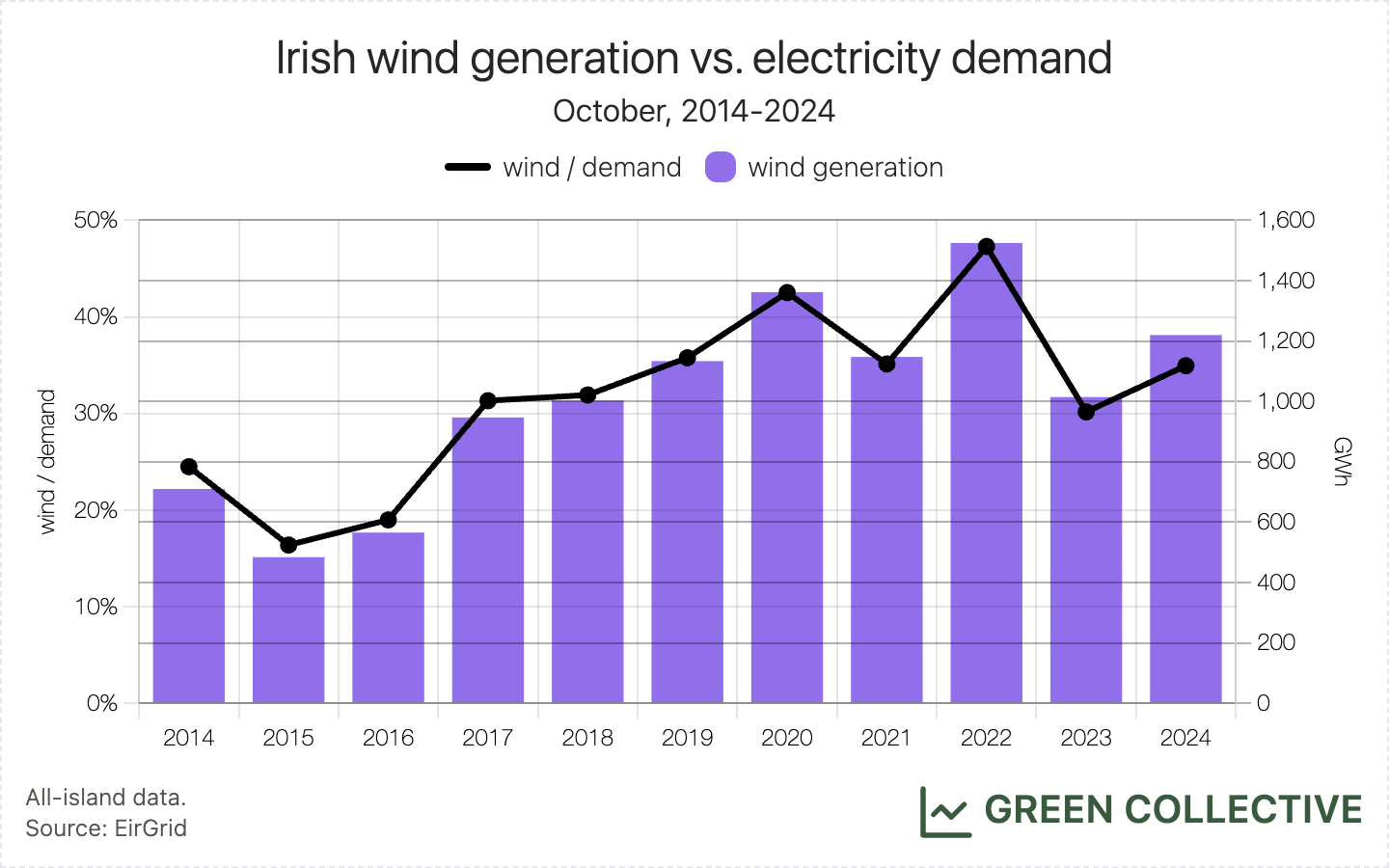

Unsurprisingly, as it comprised approximately 90% of the month's renewable generation, wind's headline partly echoes that of renewables: it was the third-best October month for wind generation (1220GWh).

However, rising demand means that it was not the third highest wind/demand ratio for an October month. Although significantly higher than October 2023's 30.2%, this year's 34.9% was otherwise the lowest wind/demand ratio for an October month since 2018.

Wind did reach one new high for an October month when output reached 4148MW at lunchtime on Friday, October 18th. We can attribute this to the handful of new wind farms added in recent years, plus technical advances on the grid. Generally, however, as we noted in last month's report, wind generation has been flat at best for the last few years. The contribution of solar to the recent improvements in Ireland's renewable generation figures is clear.

Solar

With rapid expansion and this being only the second year of significant solar on the Irish grid, it hardly needs to be said that this was the best October yet for solar generation when 51.8GWh/1.5% of solar/demand ratio is a return to March-like figures.

However, as in September, we can report that on sunny days peak output still approaches that of the summer: when EirGrid publishes utility-scale figures we will likely be able to revise October 10th's 593MW to approximately 660MW which is within 10% of the current solar output record set in August. At the time on October 10, this was equal to approximately 12% of all-island demand and it looks like solar will continue to help significantly with peak loads on sunny winter days.

Fossil Fuels

Fossil fuel generation during October 2024 equalled 49.9% of electricity demand. This was the lowest share yet seen during an October month.

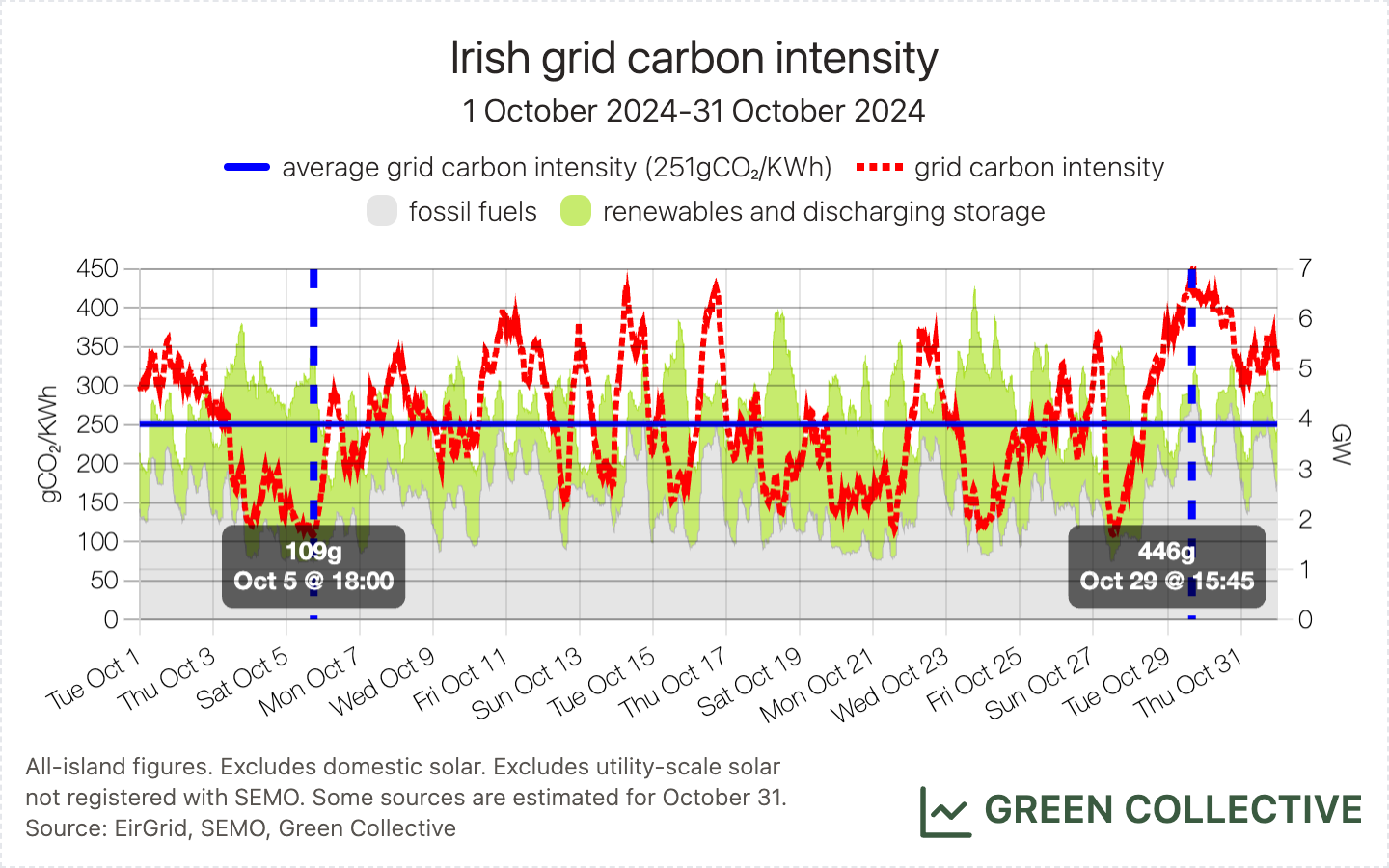

We estimate that for each kWh of electricity generated during October the Irish grid emitted between between 109g and 446g of CO₂, for an average of 251gCO₂/kWh. As has been the case every month so far this year except for July, this was the lowest grid carbon intensity yet seen in an October month.

We can attribute this welcome decline to several factors:

- Increased reliance on electricity imports since 2023.

- Displacement of peat, coal, and oil with gas. Of the four, we weight gas with the lowest CO₂ emissions by some margin and during October gas comprised approximately 90% of Ireland's fossil fuel generation which is significantly higher than in past years. We have covered Ireland's phase-out of peat generation in the past and this month we want to note that coal and - in particular - oil generation this month were both some of the lowest we've ever seen in a colder month.

So far in 2024, the average carbon intensity of the Irish grid has been 257gCO₂/kWh.

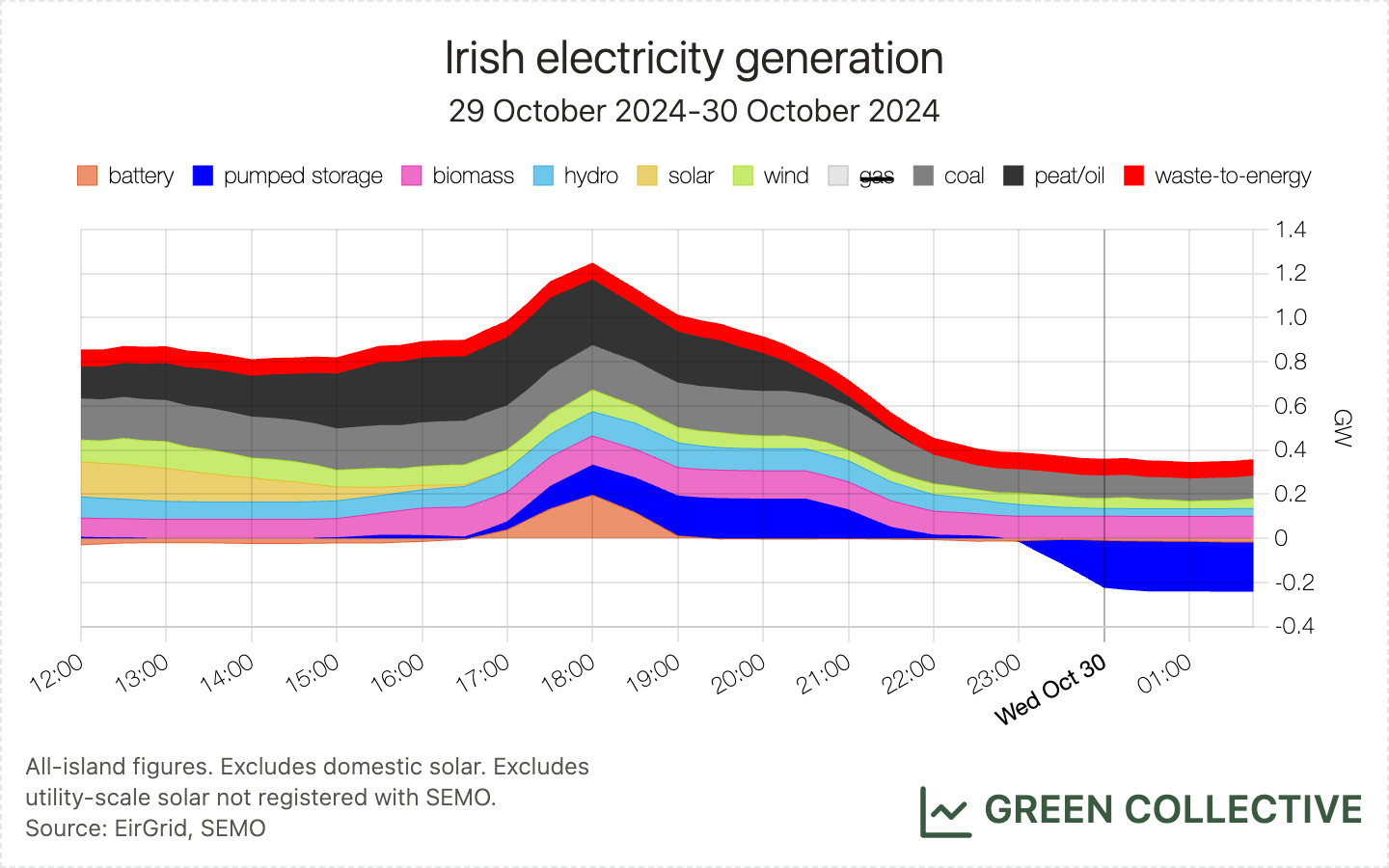

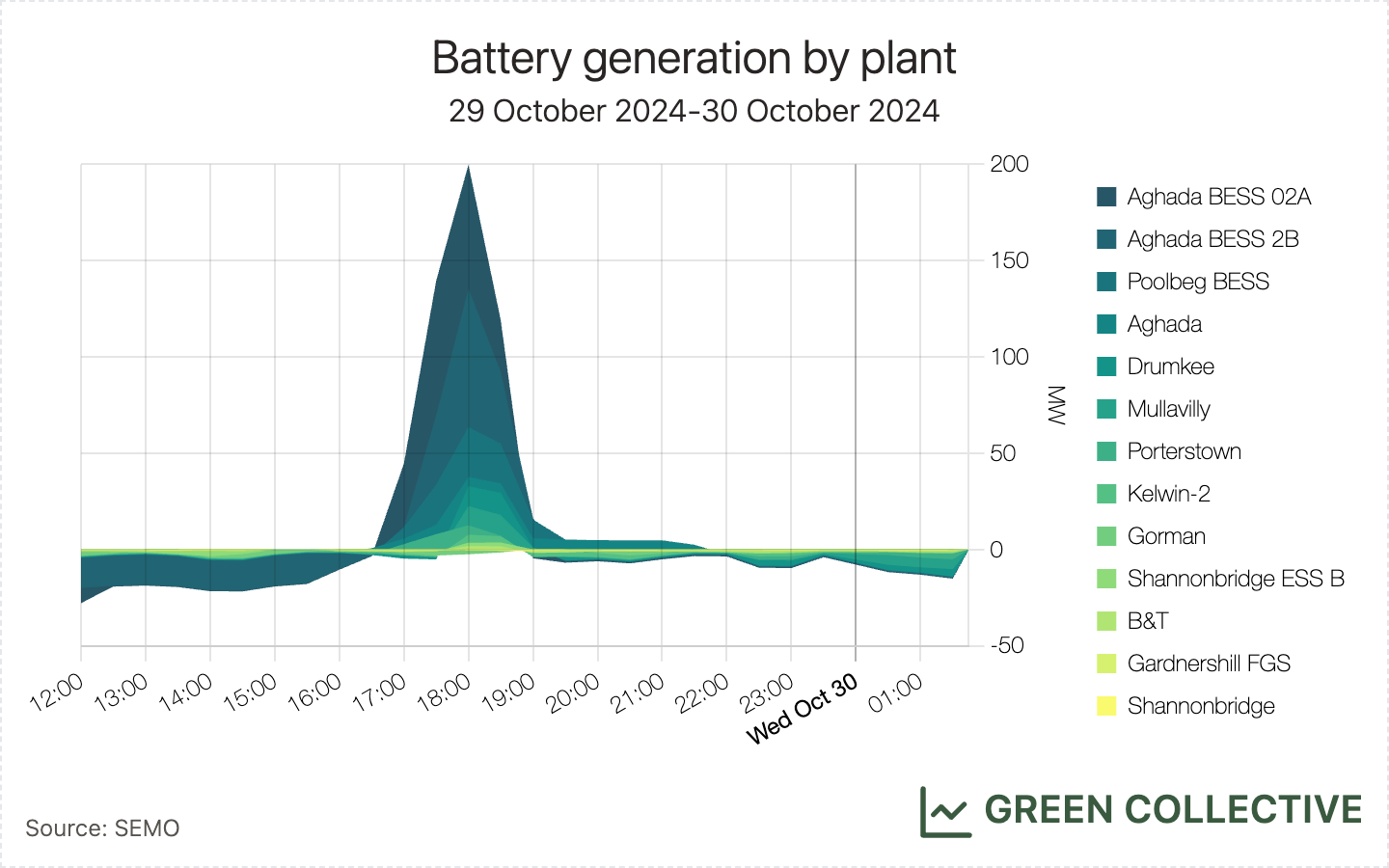

Storage

We can report that batteries on the Irish grid reached a record peak discharge of 196MW on the evening of Tuesday, October 29th. This finally beats the previous record of 175MW set all the way back in February. While 196MW remains a fraction of the island's total installed battery capacity, as market incentives change we are seeing more of the island's batteries helping out with peak demand more often, at least on low wind nights like the 29th.

Although this was a new discharge record for batteries, Sunday August 18th retains two other storage-related records:

- Mid-week demand was significantly higher, meaning that that day retains the record for peak battery/demand (3.3% vs. 3.1%).

- Turlough Hill did not reach its maximum output on the evening of October 29, meaning total storage output never exceeded 332MW, well short of August 18th's peak of 403MW. This may have allowed pumped storage to discharge for longer than usual: an interesting example of how the two may interact in future. In any case, this is surely the first time batteries have reached a higher output than pumped storage at the day's peak demand (6pm on October 29th) than pumped storage (196MW vs. 181MW).

The others

- Edenderry sprang back into action in early October after being offline since mid-July. This former peat plant represents the vast majority of the island's biomass capacity which typically adds a couple of percentage points to each month's renewables/demand ratio (comparable, currently, to solar in the colder months).

- Hydro saw its lowest ever generation for an October month. ESB recently published an informative article detailing how they typically perform maintenance at its five hydro plants over the summer. Looks like maintenance was still ongoing in October this year: October 2024's 44.8GWh from hydro less than half of October 2023's 96.8GWh.

Disclaimer and Updates

Additional data for this month, e.g. utility-scale solar generation not registered with the market operator, will become available over the next few weeks and may change some of the numbers above slightly. We will update when necessary and you can always find the most up-to-date monthly recaps on our website.

Hatches and Dispatches

We track the publications of multiple network operators to find newly connected and retired generating capacity. Delays are common in these documents but we've picked out some highlights to give you a sense of what's coming and going on the grid:

- Ballydown BESS (battery energy storage system) in County Down registered with the Single Electricity Market Operator (SEMO) in October. August publications from SONI, the grid operator in Northern Ireland, show that the connection date goes back to July 2024. This is the fifth battery energy storage asset in Northern Ireland, with a capacity of 12.2MW/12.2MWh.

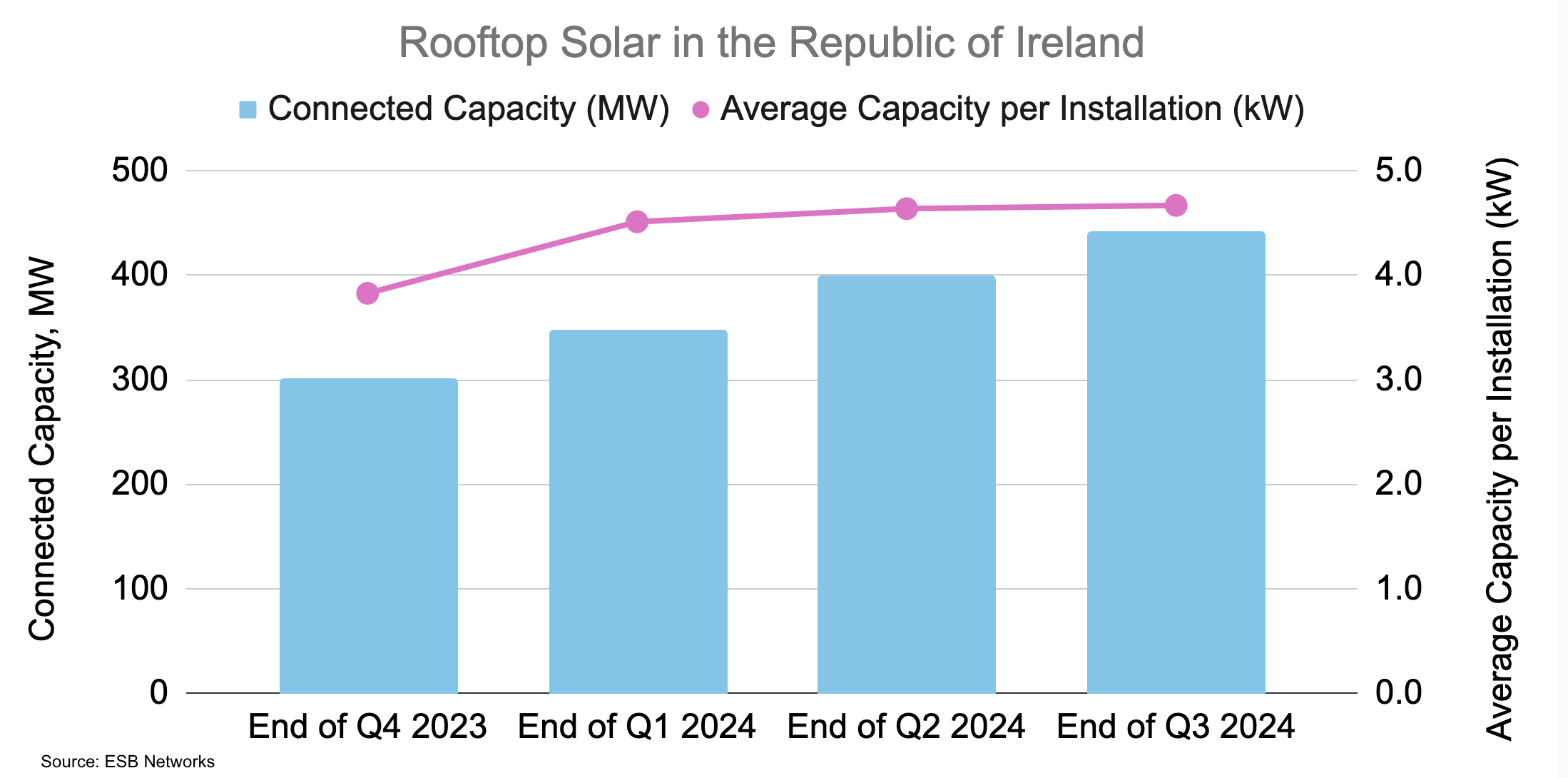

- Rooftop solar capacity in the Republic of Ireland (ROI) has reached 441MW by the end of Q3 2024. When we published our summer review in mid-October, ESB Networks hadn't updated its numbers for microgeneration and we estimated by the end of September, the ROI had 449MW of rooftop solar installed. ESB Networks has since updated their numbers on microgeneration: by the end of Q3 2024, there were 109,001 microgeneration connections totaling 441MW.

The chart above shows the cumulative connected capacity of microgeneration by quarter. In the first nine months of this year, 30,623 rooftop solar installations were connected, totaling 141MW. The rate of growth was highest from April to June, averaging 124 installations per day. From July to September, average daily installations slowed down to 98 per day, but the average size of installations in recent months remains higher than previous years at 4.7kW.

Although we had to adjust our estimates down slightly following those updated ESB numbers, these updated figures still confirm that during midday on August 31, solar farms plus microgeneration output reached 1.1GW. The revised peak rooftop solar output record is 394MW.

- An Bord Pleanála approved ESB's plan to convert Moneypoint coal units to "last-resort" Heavy Fuel Oil (HFO) units in late 2024. The approval for this fuel conversion allows HFO-fueled Moneypoint units to operate with limited run hours from late 2024 until the end of 2029. If all goes as planned, 2024 will be the last year with coal-fired electricity generation in Ireland. We don't know what will happen to these Moneypoint units after 2029, but we recently visited an art museum in Rome located in a disused power plant that may provide some inspiration.

When these Moneypoint fossil fuel units eventually retire, maybe we will also get to enjoy Ireland's industrial achievements juxtaposed against ancient history, making the energy industry more accessible to all.

Thanks for reading and you can also follow us on Bluesky and LinkedIn or send us feedback at hello@greencollective.io.